“If there’s two people most often associated with the origins of of trickle-down economics, it’s Prime Minister Margaret Thatcher & American President Ronald Reagan. Few people know, however, that the phrase was actually coined by American humorist Will Rogers, who mocked President Herbert Hoover’s Depression-era recovery efforts, saying that:

“money was all appropriated for the top in the hopes it would trickle down to the needy.”

“Trickle-down” economics began as a joke. Seriously.

Rogers’ joke became economic dogma within two generations, thanks in large part to Thatcher & her American friend Ronald Reagan.

At the centre of Reagan & Thatcher’s economic doctrine was the idea that economic gains primarily benefiting the wealthy—investors, businesses, entrepreneurs, and the like—will “trickle-down” to poorer members of society, creating new opportunities for the economically disadvantaged to attain a better standard of living.

Prosperity for the rich leads to prosperity for all, the logic goes, so let’s hurry up with those tax cuts already. The legacy of Thater/Reaganomics continues to shape modern debates over macroeconomic policy in the Western Economies, from the Blairite PFI spending in the NHS coupled with tax breaks for the buisnesses bidding for the contracts, like Virgin, to the Bush Jnr tax cuts of the mid-2000s to the deficit hawks waging war over the federal budget in Congress, tgo the Austerity of the heir to Blair, David Cameron, in the UK.

Now, nearly 80 years later, Rogers’ quip is getting the punchline it deserves: A devastating new report from the International Monetary Fund has declared the idea of “trickle-down” economics to be as much a joke as he’d imagined.

Increasing the income share to the bottom 20 percent of citizens by a mere one percent results in a 0.38 percentage point jump in GDP growth.

The IMF report, authored by five economists, presents a scathing rejection of the trickle-down approach, arguing that the monetary philosophy has been used as a justification for growing income inequality over the past several decades.

“Income distribution matters for growth,” they write. “Specifically, if the income share of the top 20 percent increases, then GDP growth actually declined over the medium term, suggesting that the benefits do not trickle down.”

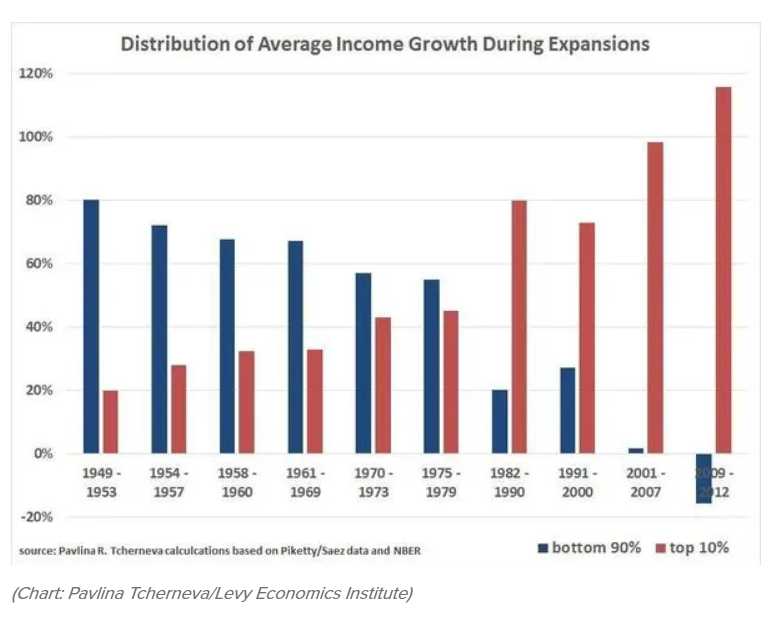

This should shock no one: Observers of income inequality over the past five years (especially those fond of Thomas Piketty’s Capital in the Twenty-First Century) will recognize this trend from economic data going back to the end of World War II. Consider this much-cited chart by Pavlina R. Tcherneva, of the Levy Economics Institute, tracking the distribution of income gains during periods of economic expansion:

According to Tcherneva’s analysis, the balance in the distribution is flipped from the majority to the top 10 percent during the Thatcher/Reagan and Blair/Bush administrations, a rapid acceleration of a gradual trend.

Income inequality was already growing, but the advent of NeoLiberal/NeoConservative economics kicked the trend into overdrive.”

This is a "Pay as You Feel" website Please help keep us Ad Free.

You can have access to all of our online work for free. However if you want to support what we do, you could make a small donation to help us keep writing. The choice is entirely yours.

You must be logged in to post a comment.